Not everyone is comfortable to talk about money to their kids. Actually, most of us even not comfortable talking about money with our parents and spouse. We found the who money thing is difficult to understand or too complex to explain. However, money is definitely not evil and with proper guidance and open communication, can be a great tool to introduce invaluable life lessons that your children will thank you for in the future. And children are smart enough to understand as long as you talk about money to them appropriately to their age.

And sometimes, “talking” does not necessarily mean engaging in a conversation. Talking about money to your child should involve practical applications and practices that match your talk.

Earning and handling money responsibly are essential life skills that your children can benefit a lot from. Teaching them early can help them form habits that will slowly integrate into their values, which will then influence their decisions in the future. As their parent and first teacher with your home as their classroom, how would you lay the right foundations?

In this article, we will tackle how to talk money to your child that is appropriate to their age, and how you can take responsibility and saving become part of their core values. If you want to check how we increase the household income and decrease spending, 10 Tips for Household Money Management!

Table of Contents

Forming Habits

According to the book, The Power of Habit by Charles Duhigg, the key to achieving success in almost everything like losing weight, raising kids, innovating, and even building revolutionary companies is in knowing how habits work.

In this case, making saving and earning money responsibly a habit for your child, will help them understand it better and make it work for them as they grow up.

Habit-forming should include patience and consistency on your end. You might encounter some reluctance at first, especially when your child suddenly felt deprived of inconveniences when you teach them about saving and budgeting.

Hence, it is best that early on, you teach them about delayed gratification.

For example, spare buying new toys, clothes, and even serving special food during occasions only. By not giving in to the whims inside a toy store, you also teach an invaluable skill of self-control.

Forming healthy money habits is a great foundation for every person, regardless of whether he or she is already earning. Starting to “talk” about money does not have to be a literal conversation; it is best to get them to form habits that will, later on, help them understand what you are going to teach them.

Family Values

Talking and teaching about money skills will be easier if your family already practices them. Children mimic their environment with their parents as their role models. Talking about money will become more comfortable if it is openly discussed as a family and they already see the values you will teach them being practiced at home.

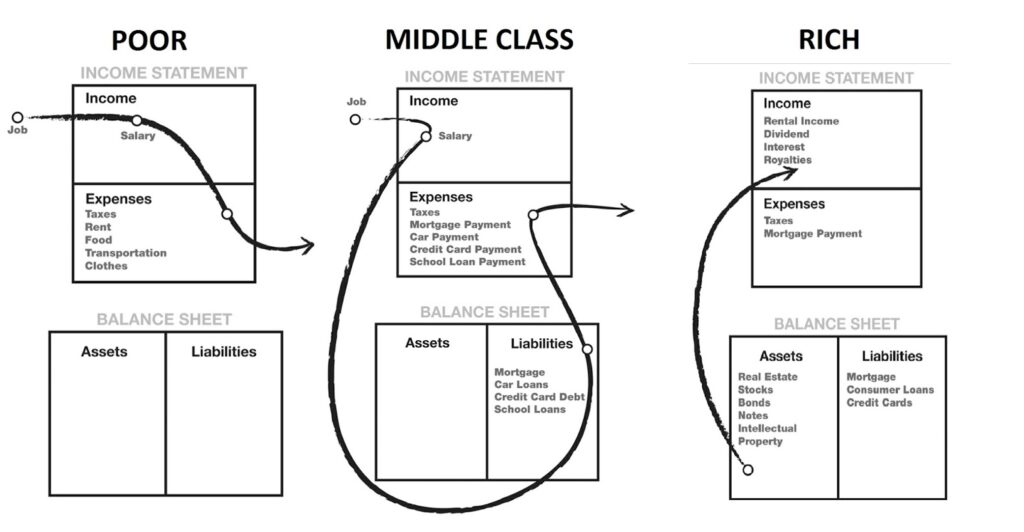

Just be wary of talking about money problems to your children; they may not have understood it as you would have to as an adult and may backfire. Instead, imparting values about saving and investing can help them address their future money problems.

When talking about money, do not just focus on future value, but also on gaining immediate conveniences using it. For example, encouraging them to earn money to buy something for themselves by doing extra chores apart from their usual responsibilities. The reward is immediate and this will help them look for more opportunities when they want to.

Talking about money to your children should be coupled with action. They will learn best when they see the concepts being practiced in real-life situations. Tell them that your time away from home is spent working in exchange for money. Therefore, this teaches them that in some cases, time equals money, which will help them, later on, to decide what’s worth their and your time – earn or spend. It will also help them appreciate what you use your money for like food, bills, clothing, and vacations.

Making it Work for You

Everyday decisions can also become a teachable moment for your child when it comes to money. Bring him or her to your grocery shopping and exercise some math concepts that they have been learning from school. Money is a great tool to teach math and can help your child relate real-life situations to their school lessons, which can also help them grasp and understand the concepts better.

Talking about money, forming responsible habits around it, and gaining the right values will not just benefit your child but you as well. Making money a comfortable topic with your child and your family can help you run the home more smoothly. With everyone cooperating in saving and delaying gratification, you can all reap its future value and appreciate everything you have better.

Age-Appropriate Money Tips

For you to effectively talk about money to your children with intent, you must do so that is appropriate to their age. The topic of money comes with the wisdom that can benefit your children. Starting them young can help them navigate life better in the future.

1. Toddler

Children as young as 2 or 3 can already grasp some basic concepts about money. And children of this age can better grasp concepts through play.

For example, you can introduce coins and teach them how to know which is a dime, a quarter, or a penny. You can also do some basic counting without actually considering the coins’ real value, too.

Pretend play like restaurants and groceries are also great means to teach about money. You can show how to avail of food or services by exchanging play money with it, which is also how commerce is practiced in real life.

You can also introduce that trusty piggy bank. Children can have tireless fun putting in coins inside while you actually introduce them to the concept of saving.

2. Young Schooler

As soon as you start giving your child an allowance or when he starts receiving monetary gifts from your relatives or friends, you can now elevate the lessons you teach them about saving.

Bring your child to the bank and ask the manager to help discuss the concept of savings and interest. Allowing an expert to talk can help your child believe and understand it better. Allow your child to monitor his money’s growth by enrolling the account in online banking or getting a passbook with it.

Meanwhile, if your family is into traveling, you can introduce the hobby of money collecting. It can elevate your child’s appreciation of the different currencies of the world in terms of appearance. When old enough, you can also impart some history lessons and even conversion rates.

When your child is old enough, say about 9 or 10, you can now start comparing labels and prices in the grocery. Allow them to see different brands and compare their prices and content to see what is the best value to get. Bring a list and set a spending budget for each grocery run and make sure that everything is ticked off within the budget.

3. Teenager

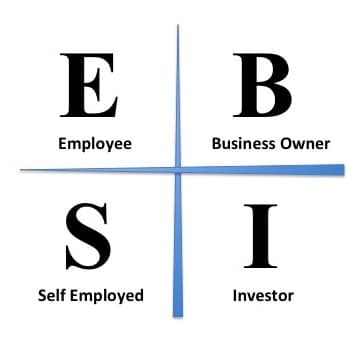

At this stage, you can now talk about earning money and investing. Teenagers are keen on being independent, so tell them that talking and teaching them about money is good preparation for it.

You can encourage them to do garage sales of their old and outgrown items at home. Or, set them off to entrepreneurship by teaching them baking, cooking, repair, or woodwork skills.

Allowances should also be discussed and allow them to speak up about their needs or wants. Be open about your capabilities and earning capacity and how much you can only support. If you can, be open about allowing them to do part-time work to support their hobbies or just to learn more about earning and handling money.

4. Adults

It is never too late to talk teach your adult child about money. Even your adult children can still learn from your experience and guidance.

Being comfortable talking about money with your children, regardless of age, can also strengthen your bond. Learning from each other’s experiences can also help you navigate life better.

As a parent, seeing your child’s perspective about money can help you correct, discipline, and guide him through life. Money has a huge impact on most of our decisions, thus, it is best to know how to handle it.

Conclusion

Starting your children young on money is great. Talking and teaching about it will instill valuable lessons they can learn and apply in many situations and challenges.

As much as you can, make money talks or conversations with your child, positive. Focus on future gains and benefits that come with earning responsibly, and saving and investing correctly. Yet, spare some time discussing potential money problems but also relating the value of money discipline in helping you solve them.

With habit formation, having the right values, and these tips, you can now have more meaningful talks about money with your child today.

About Me

Hi, there. I am Lin. Together with my husband and two kids, we live in the beautiful Netherlands in Europe. I am dedicated to self-development, creating quality time for the whole family, and fully supporting kids with their potentials and possibilities with all I have learned from engineering, MBA, and 10+ years of working experience in the energy sector.